The Slow-Living Business Owner: Why rest helps your revenue

The end of the calendar year can turn even the calmest business owner into a slightly frantic version of themselves. There’s work to wrap up, kids’ events to juggle, inboxes that seem to multiply overnight, and that pressure to “finish everything before Christmas” (even when half of it could easily wait for January).

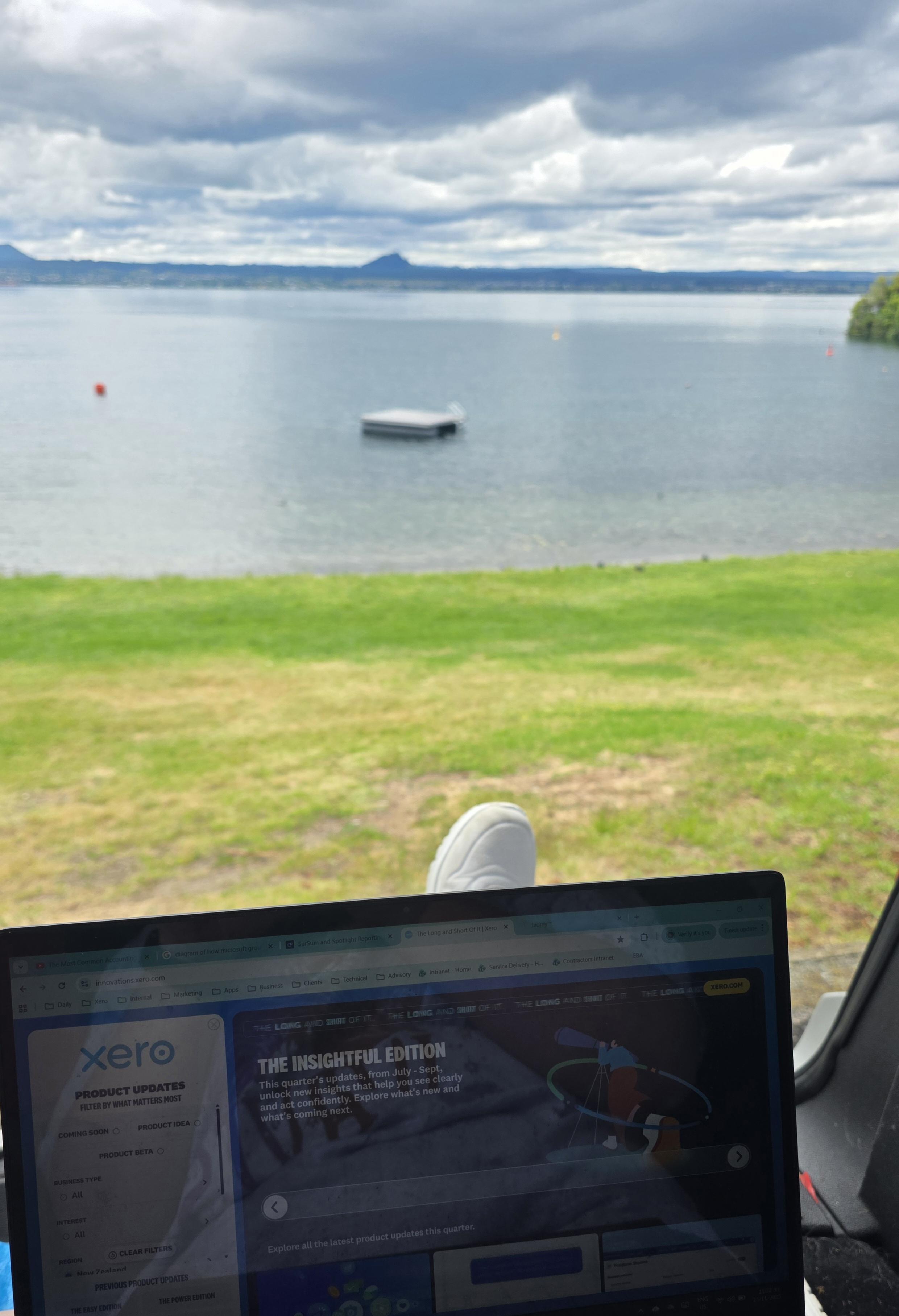

Recently I found myself working from the back of my car, parked beside a lake with my laptop and a half-melted iced latte. My work setup is wherever I can make it work at the moment, with plenty of life changes happening in the background. But despite the chaos, that moment felt unexpectedly centred. It reminded me of something I see in clients all the time: when you create a bit of space, your decision-making gets sharper.

This mindset matters, especially at this time of year.

Because as much as December can feel like a sprint, it’s actually one of the most important times to slow down enough to think clearly about the things that genuinely impact your bottom line. Things like your cashflow over the next few months. Your actual tax position heading into EOFY. What you need to tidy up before March, and what can wait without consequence.

We hear all the time that more effort equals more progress. If that was true, most small business owners would be flying first class! However, pushing harder usually leads to rushed choices, missed details, and avoidable tax or cashflow surprises later.

From my view as a Chartered Accountant, I can tell you this: the business owners who make the best financial decisions are not the ones running the fastest. They’re the ones who give themselves enough breathing room to think properly.

Slowing down isn’t a luxury. It’s practical. It’s strategic. It lets you look at your numbers without panic. It gives you the headspace to review pricing, tidy up your bookkeeping, get a realistic view of your obligations, and actually understand how your cashflow is tracking into the new year. Conversations with your team, your accountant, or even your future self become a lot easier when you're not stretched thin.

Finding that reset doesn’t require disappearing to an expensive retreat. Small shifts help - take a quiet 20 minutes without a phone, schedule in one pocket of time each week for a “CEO hour” where you look at your numbers or check in on what’s working, give yourself permission to leave December tasks that won't make a dent in your tax position anyway and go for a walk.

The calendar year-end is noisy. Rest cuts through that noise so you can start January with a clearer head and fewer financial surprises brewing. Your business won’t crumble if you switch off earlier. In fact, your cashflow, your planning, and your decision-making will all thank you for it.

If you want to set the tone for a more sustainable year - one where you stay on top of your financials without burning yourself out - slowing down now is a smart place to start. You’ll make better choices, and you’ll enter January feeling like a person again rather than someone playing catch-up.

If working together is something you'd like to explore in future, our books reopen in 2026. You’re welcome to join the waitlist by emailing [email protected], and we’ll get in touch when spaces become available.